Helping Brooklyn Businesses Save More, Grow Faster, and Build Wealth — For Over 30 Years

Winston P. Thompson, CPA and Financial Planner, brings over three decades of experience in tax, audit, and financial planning. From Wall Street investment banking and Big Five accounting to serving local entrepreneurs, Winston has guided hundreds of businesses in Brooklyn and Long Island to reduce taxes, protect profits, and achieve long-term financial success.

✔ 30+ Years of CPA Experience

✔ Hundreds of Small Businesses Served

✔ Local Expertise with Global Insight

Our Core Services

Accounting & Tax

From start-ups to established businesses, we handle your accounting and taxes so you can focus on growth.

Wealth Management

Our personalized wealth strategies help you grow assets, protect profits, and plan for long-term success.

CFO On-Demand

Access senior-level financial expertise without the cost of a full-time CFO — tailored to your business stage.

Free Resources for Business Owners

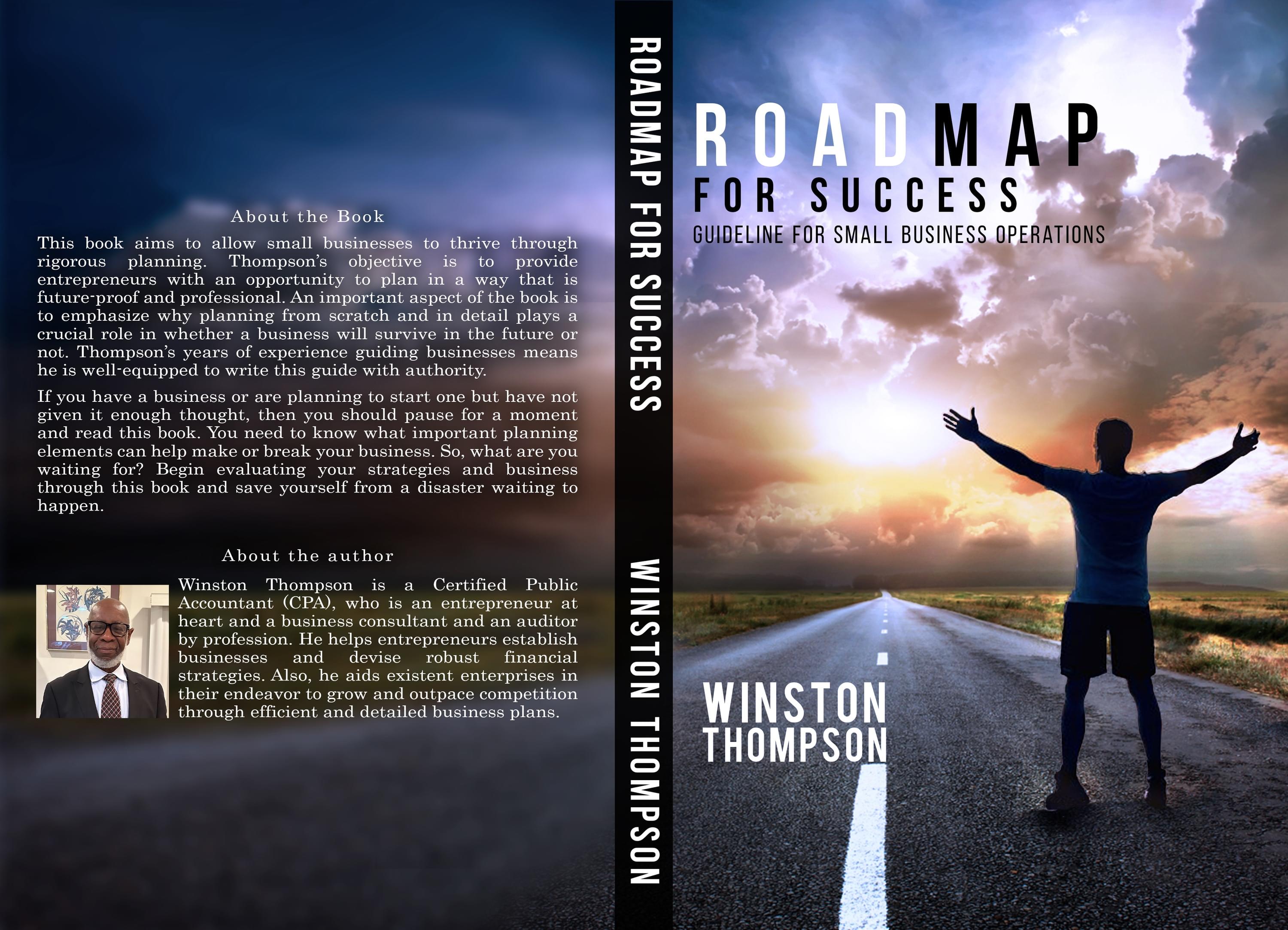

📘 Roadmap for Success

Discover proven strategies to future-proof your business with Winston’s Roadmap for Success.

💵 5 Tax Saving Tips

Get 5 practical, easy-to-apply tax-saving strategies to keep more of your money each year.

🏆 Wealth Building Club

Join our exclusive Wealth Building Club for weekly insights, strategies, and tools to build generational wealth.

💵 5 Tax Saving Tips

Get 5 practical, easy-to-apply tax-saving strategies to keep more of your money each year.

🏆 Wealth Building Club

Join our exclusive Wealth Building Club for weekly insights, strategies, and tools to build generational wealth.

Meet Our Expert Advisors

Home Seller's Guide

Home Buyer's Guide

Free Home Value

Progress Always Begins Where Your Comfort Zone Ends

Vikram Sharma

Digital Assets Advisor

Helping financial professionals and business owners integrate crypto and DeFi solutions into their strategies.

Joe Aloi

Accounting Services

20+ years of experience supporting small businesses with tax planning, compliance, and bookkeeping.

Donnyell Bourgeois

CFO Services

Former Fortune 500 CFO bringing executive-level financial management expertise to growing companies.

Office Hours

Monday - Friday

9AM-5PM

Let's Connect

Whether you have a question, want to explore a growth opportunity. or need expert funding guidance-we're here to help.

Phone

718-875-0556

Location

155 Water St, Brooklyn, NY 11201

Get In Touch

Reach out for expert guidance

Number

407-341-1142

Location

400 Fontana Circle Suite 104 Oviedo Florida 32765

Testimonials

John Workman, PhD(Real Estate professional)

Thompson & Company’s ROADMAP FOR SUCCESS is a system and planning tool that small businesses can use. I highly recommend it.

Parish Shah, (Registered investment advisor)

Thompson & Company’s ROADMAP FOR SUCCESS is a system with the right tools to help small business manage their operations and grow their businesses.

Nick Perry,(US Ambassador to Jamaica)

My district is home to thousands of small businesses. I'm also aware that they struggle to keep their doors open. The challenge for them has always been a lack of a step-by-step system. Thompson & Company’s ROADMAP FOR SUCCESS satisfies this in seven steps.

Got Questions?

We're Here to Help.

Whether you're wondering if Thompson & Company is right for you, or just want to know how our process works - we've got answers.

What is your process of working with clients?

We believe that every business, regardless of size, deserves access to quality accounting & tax services, which is why we offer a free consultation to prospective clients. During your consultation, we’ll take the time to understand your business and financial goals, identify any immediate accounting & tax needs, and provide you with a customized plan that fits your budget.

What are some of the services provided by your firm?

We offer a wide range of services, including bookkeeping and accounting, tax planning and preparation, financial statement preparation, audit and assurance services, payroll processing, and business consulting and advisory services. We also offer specialized services for particular industries, such as technology or healthcare.

What are the benefits of outsourcing accounting & tax services?

Outsourcing accounting & tax services can offer many benefits for businesses, including saving time and money. Businesses can focus on their core competencies without having to worry about complicated accounting & tax procedures. You also get access to specialized expertise, as accounting firms often employ a broad range of professionals with expertise in various financial areas.

Do I need to hire a tax professional to file my taxes?

No, you can choose to file your own taxes with the help of tax preparation software or by using the IRS Free File program. However, if you have a complex tax situation, it may be beneficial to seek the assistance of a tax professional.

How long does it take to receive a tax refund?

The timeframe for receiving a tax refund depends on how you filed your taxes and how you opted to receive your refund. If you filed electronically and opted for direct deposit, you can typically expect to receive your refund within a few weeks. If you filed a paper return or opted for a paper check, it may take longer to receive your refund.

How can accounting & tax services help my business grow?

Accounting & Tax services can help businesses grow by offering financial guidance and advice. Accounting professionals can analyze a company's financial records, identify areas for improvement, and provide recommendations for increasing profitability. They can also help businesses make informed financial decisions by forecasting financial results and evaluating potential risks.